首頁(yè)

學(xué)校概況

- 學(xué)校簡(jiǎn)介

- 校長(zhǎng)寄語(yǔ)

- 領(lǐng)導(dǎo)關(guān)懷

- 學(xué)校宣傳片

- 辦學(xué)理念

- 辦學(xué)成果

- 辦學(xué)特色

- 校園風(fēng)景

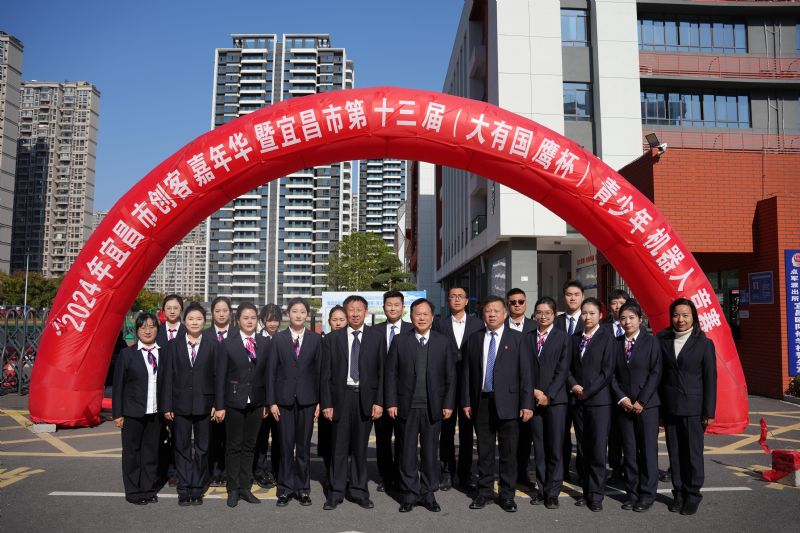

校園動(dòng)態(tài)

- 學(xué)校新聞

- 通知公告

- 學(xué)校視頻

教師風(fēng)采

- 名師風(fēng)采

- 高中部教師

- 初中部教師

學(xué)生風(fēng)采

- 榮譽(yù)表彰

- 精彩瞬間

教育教學(xué)

- 德育工作

- 教學(xué)教研

國(guó)際教育

- 國(guó)際部簡(jiǎn)介

- 國(guó)際課程

- 國(guó)際交流

- 社團(tuán)活動(dòng)

- 師資團(tuán)隊(duì)

- 杰出校友

學(xué)校黨建

- 黨員先鋒

- 黨建動(dòng)態(tài)

- 文明創(chuàng)建